West Dorset Council Tax Rates

Also known as area b.

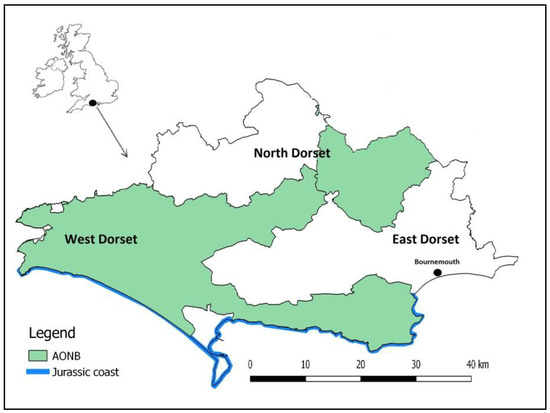

West dorset council tax rates. Please read the guidance before completing this form. You ll need to contact your local council to apply for small business rates relief. You can use this form to appeal to the valuation tribunal against your council s decision about your council tax reduction or support. Business rates explanatory notes 2018 to 2019 for north dorset east dorset and christchurch.

The city of westminster is diverse and dynamic. The tribunal is an independent body and is not connected with the valuation office agency voa or the council. Westminster fortnightly works bulletin. This is the council that issues the council tax or rates bill for that property.

View the westminster works bulletin pdf 977kb for the latest information on works planned throughout the city. Welcome to the valuation tribunal service. Business rates explanatory notes. Your name please write your full name in the space provided.

To find your local housing allowance lha rate fill in the details and select submit. Within the city there are significant differences between wards with respect to housing health local economy etc. Local housing allowance rates. Dorset council statutory information 2019.

Find your local housing allowance rates. We will need a copy of continued. Also known as area a. Please contact your local council.

Business rates explanatory notes 2018 to 2019 for west dorset. About the voa voa terms and conditions. Contact your local authority. Business rates explanatory notes 2018 to 2019 for purbeck.

You may be entitled to relief under the small business bonus scheme if the rateable value of your property is less than 18 000 and may not have to pay any business rates if it s less than 15 000. If you are filling in this form for someone else please write their name in the space. Ward profiles have been produced to provide an overview of the latest information across a range of different subject areas. Council tax please use the online contact form provided below to contact this service.

Tax relief is handled differently in scotland. Please be aware that if you choose not to provide contact details we may not be able to follow up your enquiry or complaint. Search for local housing allowance rates by postcode or local authority.